- #FIXED ASSET TURNOVER INTERPRETATION HOW TO#

- #FIXED ASSET TURNOVER INTERPRETATION SOFTWARE#

- #FIXED ASSET TURNOVER INTERPRETATION SERIES#

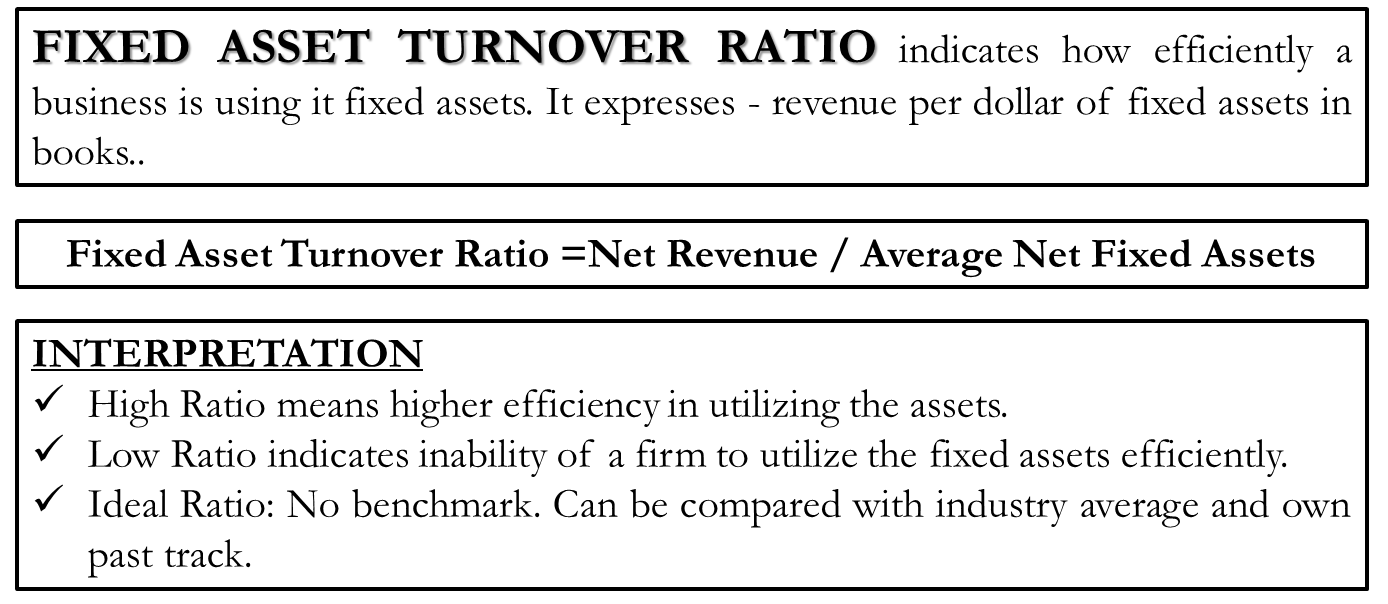

The Asset Turnover Rate essentially measures the efficiency of how a business’ or farms’ capital is being used. The Asset Turnover Rate is measured as a percentage, the higher the percentage the stronger the business or farm. Looking at the Financial Efficiency of a business or farm assists the owner(s) in determining how the various aspects of the business such as production, financing, marketing, etc.… effects the gross income of the business. The term Financial Efficiency refers to how effectively a business or farm is able to generate income.

#FIXED ASSET TURNOVER INTERPRETATION SERIES#

This series of articles will look at 21 commonly used ratios and indicators.Īsset Turnover Rate is a measurement of Financial Efficiency and is determined based on information derived from a business’ or farm operations financial statements. Multiple ratios and indicators must be used along with other information to determine the total and overall health of a farming operation and business. You cannot look at a single ratio and determine the overall health of a business or farming operation. There are a minimum of 21 different ratios and indicators that can be looked at by many financial institutions. The ratio is also sometimes known as the fixed asset ratio.Financial Ratios & indicators can assist in determining the health of a business. The fixed asset turnover ratio is similar to the tangible asset ratio, which does not include the net cost of intangible assets in the denominator. Thus, a business whose management team deliberately decides not to re-invest in its fixed assets will experience a gradual improvement in its fixed asset ratio for a period of time, after which its decrepit asset base will be unable to manufacture goods in an efficient manner. Ongoing depreciation will inevitably reduce the amount of the denominator, so the turnover ratio will rise over time, unless the company is investing an equivalent amount in new fixed assets to replace older ones. Accelerated DepreciationĪ potential problem with this ratio may arise if a company uses accelerated depreciation, such as the double declining balance method, since this artificially reduces the amount of net fixed assets in the denominator of the calculation and makes turnover appear higher than it really should be.

#FIXED ASSET TURNOVER INTERPRETATION SOFTWARE#

In other industries, such as software development, the fixed asset investment is so meager that the ratio is not of much use. The fixed asset turnover ratio is most useful in a "heavy industry," such as automobile manufacturing, where a large capital investment is required in order to do business.

Several cautions regarding the use of this measurement are noted below. = 3.0 Turnover per year Problems with the Fixed Asset Turnover Ratio The calculation of ABC's fixed asset turnover ratio is: Sales over the last 12 months totaled $9,000,000. Net annual sales ÷ (Gross fixed assets - Accumulated depreciation) = Fixed asset turnover ratio Example of the Fixed Asset Turnover RatioĪBC Company has gross fixed assets of $5,000,000 and accumulated depreciation of $2,000,000. Do not include intangible assets in the denominator, since it can skew the results. It may be necessary to obtain an average fixed asset figure, if the amount varies significantly over time. The formula for the ratio is to subtract accumulated depreciation from gross fixed assets, and divide that amount into net annual sales.

#FIXED ASSET TURNOVER INTERPRETATION HOW TO#

How to Calculate the Fixed Asset Turnover Ratio A corporate insider has access to more detailed information about the usage of specific fixed assets, and so would be less inclined to employ this ratio.

The concept of the fixed asset turnover ratio is most useful to an outside observer, who wants to know how well a business is employing its assets to generate sales.

0 kommentar(er)

0 kommentar(er)